Interconnection Destiny is Not Predetermined

Introduction:

Spoiler alert for a 30-year-old movie: Toward the end of Back to the Future Part III, the main characters share an exchange summarizing time travel in their universe:

Jennifer Parker: Dr. Brown, I brought this note back from the future and now it's erased.

Doc: Of course it's erased!

Jennifer Parker: But what does that mean?

Doc: It means your future hasn't been written yet. No one's has. Your future is whatever you make it. So make it a good one, both of you.

Marty McFly: [Marty wraps his arm around Jennifer] We will, Doc.

Believe it or not, this obscure and outdated reference is actually relevant to generator interconnection; it’s not uncommon for stakeholders to believe a project’s fate is set upon entering the queue. In this article, we’ll discuss why this is not always true, how a developer’s decision-making process can impact the fate of a project, and ways to utilize scenario analysis to gain more confidence in a project’s interconnection destiny.

MISO DPP-2018-APR-West Categories:

As an interconnection solutions company, we examine a lot of data from queues across the country. For this article, we’ve pulled the public reports from Phases 1-3 of MISO’s DPP-2018-APR-West cycle and have categorized them to reflect common decisions faced by developers. An example of each project category can be found below:

Brute Force: A project seeks interconnection regardless of cost and posts large securities along the way.

Immediate Withdrawal: A project withdraws due to high Phase 1 results or other development problems.

Ideal Project: A project’s cost allocations start low and stay low.

Light at the End of the Tunnel: A project has a high starting or intermediate cost that ultimately comes down, even if Phase 2 results go up.

Limited Optimism: A project advances (willing to stomach incremental risk) and then withdraws because costs are still high in Phase 2

Wrong way: Costs jump exponentially in Phase 2 or a project’s costs incrementally increase from Phase 1-3.

A full list of the DPP-2018-APR-West projects by category can be found in the Appendix.

So, is a Project’s Interconnection Destiny Pre-Determined?:

We think Doc from Back to the Future III would say, “No, a project’s interconnection fate is not set in stone. It is you, the developer, who shapes the destiny of the project, so make the best decisions you can.”

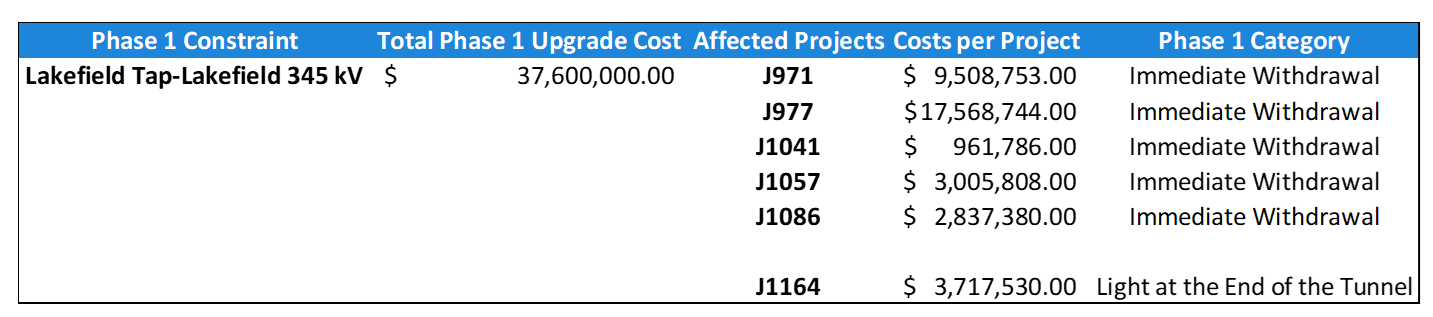

For our first example, let’s analyze the Phase 1 DPP-2018-APR-West Lakefield Tap constraint in Figure 1 below. Six (6) projects—J971, J977, J1041, J1057, J1086, and J1164—contributed to this constraint and were each allocated a portion of the $37,600,000 to rebuild 18.8 miles of the transmission line. Of these six projects, five immediately withdrew due to other development issues or sticker shock from their Phase 1 cost allocations including the Lakefield Tap constraint. The remaining project, J1164, went on to sign a generator interconnection agreement (GIA).

Figure 1: DPP-2018-APR-West Lakefield Tap Constraint, Phase 1

Project J1164 exemplifies the notion that project categories and interconnection fate are not predetermined. This project’s developer entered the DPP-2018-APR-West cycle and discovered that they had been allocated $40,748,786 in shared network upgrade costs. From Figure 1, we know that J1164 contributed to the Lakefield Tap Constraint in Phase 1 to the tune of $3,717,530. But if you take a look at Figure 2 below, you’ll see that this constraint completely disappeared in Phase 2 and Phase 3 results. Why is this? Well, J1164 can partially thank the five other projects that decided to withdraw from the queue in Phase 1, as the need for the network upgrade fell out due to these withdrawals.

Going one step further, all of J1164’s constraints in Phase 1 disappeared in subsequent phases, likely due to other projects’ changes and withdrawals, and decisions made by its developer. Figure 3 illustrates the decisions J1164’s developer made to improve its chances of signing a GIA. Not only did J1164 reduce capacity from 200MW to 80MW but it also changed its service type from NRIS to ERIS. By the time Phase 3 rolled around, J1164 had reduced its interconnection costs by nearly $35 million, signed a GIA, and ultimately received either a significant development fee or long-term revenue from a successful project.

Figure 2: Project J1164 Phases 1-3 Constraints and Cost Allocation

Figure 3: Project J1164’s Changes in Phases 1-3

How to Shape a Project’s Interconnection Destiny:

Going back to Figure 1, we categorized projects J971 J977, J1041, J1057, and J1086 as “Immediate Withdrawal.” In other words, their developers saw high preliminary costs and decided to withdraw due to diminished project economics or the prospect of posting multi-million-dollar securities. However, these decisions may have been premature. Similar to how the Lakeview Tap constraint disappeared in Phases 2 and 3 for J1164, it is possible that similar changes to cost allocation could have occurred for the other five projects.

But is there a way to forecast interconnection risk in future phases? Yes. One option would have been for the other five developers to run “side” interconnection studies internally or through consultants. The problem with this tactic, however, is that these side studies usually take weeks and might only analyze one scenario.

We believe a better option is to leverage scenario analysis software that enables user-defined assumptions to provide same-day probabilistic cost allocations across any number of scenarios. This type of software allows users to answer questions such as:

What happens if another project in the queue withdraws?

If we change project capacity or service type, do our cost allocations change?

What if a project from last year’s cluster withdraws and the upgrade they were

paying for now gets assigned to us?

If after running multiple scenarios, the “Immediate Withdrawal” developers saw their cost allocations decrease due to constraints disappearing (e.g. the Lakefield tap example) they might have felt more confident moving forward, thus increasing the chances of a GIA and subsequently unlocking project value.

Of course, scenario analysis can also help stakeholders understand when to cut their losses and move on. If after running multiple scenarios, the “Immediate Withdrawal” developers saw their costs staying the same or increasing, the developers would have felt even more confident in their decision to withdraw.

Conclusion:

The main takeaways from this article are that a project’s fate is not predetermined upon entering a queue and that decision-making is best supplemented by scenario analysis. If you’re interested in learning more about scenario analysis, please reach out to us and we can explain how our software platform, Interconnect™, can help equip you with high-quality data to use at any point in the interconnection lifecycle.

Appendix: